Taxing a car without a V5 logbook, V11 tax reminder or green slip (new keeper supplement).

It is against best practice and government advice to buy a car without its DVLA V5C registration certificate, informally known as the logbook.

It becomes especially difficult when you want to buy road tax.

- Jump To Car Tax Without Reminder Or a Logbook

- Use this link if you have Lost Your Logbook And Want To Buy Or Sell a Car

Buying a car that doesn’t have all its documentation?

- The car could be stolen

- Maybe a previous write-off

- Could be cloned

Not to mention, you can’t tax your car (usually, but not always). To find this type of vehicle information, use a Free Car Check via this database. It’s the first step to all available car history.

How to tax a car without V5 logbook?

You cannot transfer car tax and in many cases you need the vehicle log book alongside a valid MOT and car insurance.

To road tax a vehicle, you usually need to have ONE of the following:

- V11 reminder letter

- V5C logbook registration certificate (registered in your name)

- V62 Logbook application form (when the car is registered in your name)

- V5C/2 Green slip (or Section 6 on the new style V5), new keepers supplement (when you have just bought the car not registered in your name)

In some cases you may be able to get new car tax without the V11, log book or new keeper’s supplement.

If you don’t have the documentation, follow these steps:

Head to your local post office with a valid MOT, car insurance certificate and completed V62 form along with the associated £25 logbook application fee.

It’s good to take some identification with you as well (usually your driving licence).

The next item you’ll need is the name and address of the existing keeper (the person whom you have just bought the car from).

It may be a private seller, a motor dealer or car auction house.

Ideally, you’ll present the registered keepers details with an invoice or receipt of purchase.

If you have all of this information, a percentage of post office clerks will tax your new car on the spot. If you’re refused, try a different post office.

We’ve had considerable success using this method.

Need advice on selling your car?

See our latest guide to Sell My Car Online, composed by automotive experts at CarVeto.

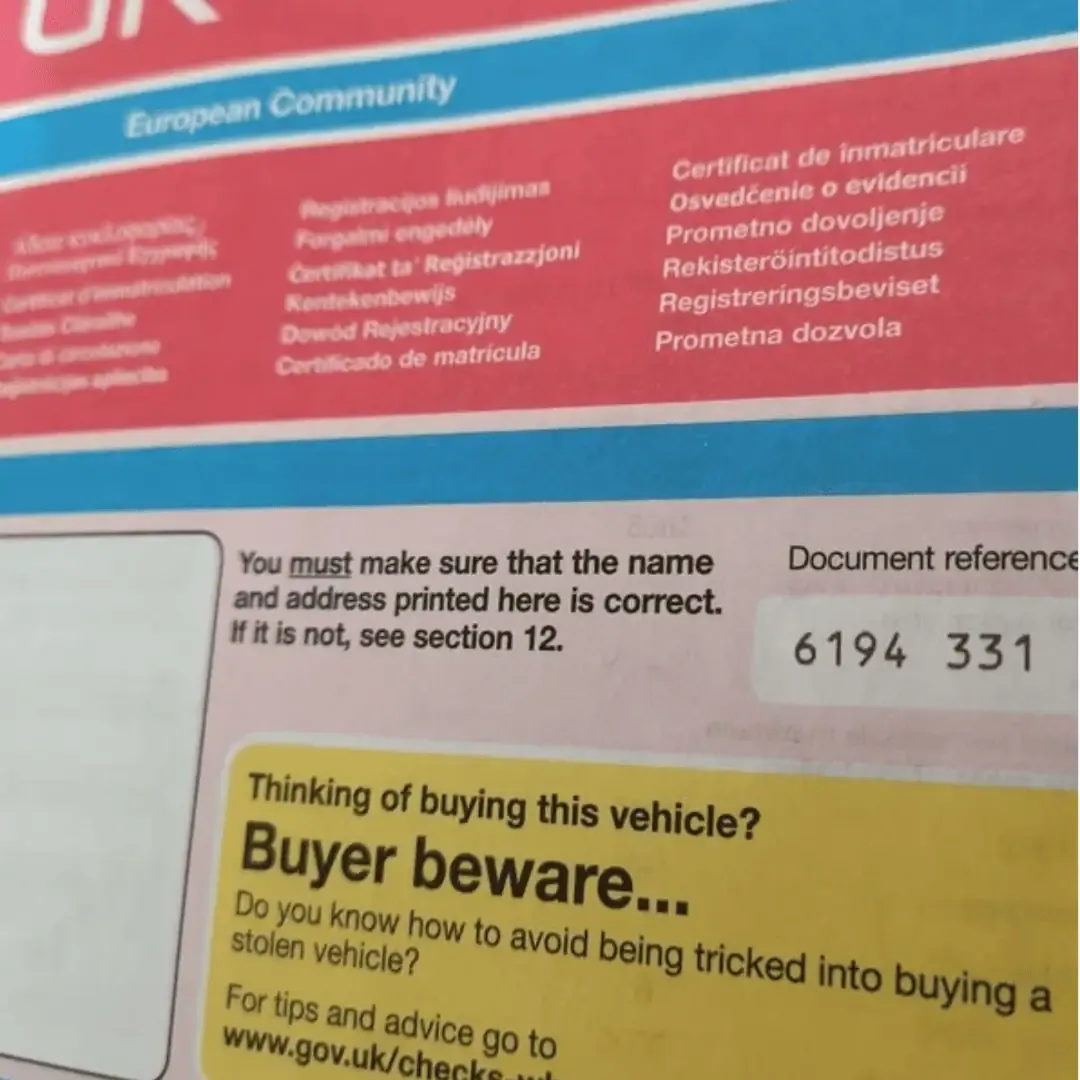

[Graphic displaying the front and back of a V5 vehicle registration document]

What if I don’t have any of the correct documentation?

Without one of these DVLA forms, you cannot tax the car.

Instead, you need to follow these steps:

- Apply for a logbook via the V62 Form.

It’s quick to complete, but there is a fee of £25.

DVLA state it can take up to six weeks to get a new logbook V5.

We have applied for a lot of registration V5 documents over the last 30 years, and on average, it takes ten days to get the new car doc.

When you buy a car, you must have road tax, valid MOT and insurance. Without them, you are breaking the law and will get a fine from DVLA.

- After you’ve applied for a logbook, you need to Declare SORN.

That means the car is taken off the road (Statutory Off-Road Notification) until the new logbook arrives.

Note, there are no exceptions or shortcuts to this rule.

But, you don’t need to tax or insure the car during SORN notification.

If you have bought without V5C, check and see is the car stolen or written off.

Here to help

CarVeto runs a small, expert team of automotive professionals. If you are concerned that you have bought a stolen car or have a related question to DVLA documentation or Taxing a Car, get in touch with us for some help.